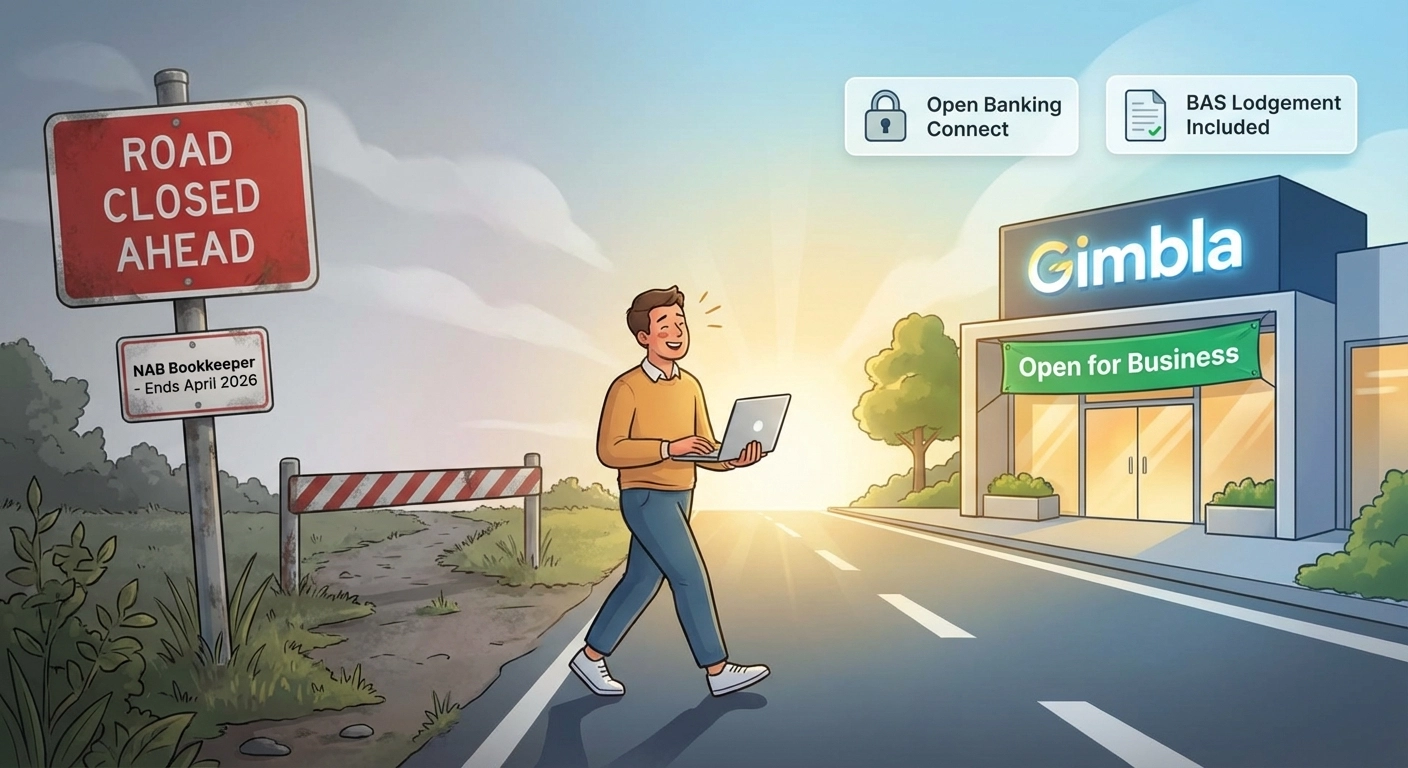

NAB Bookkeeper is Closing in April 2026: We’re Here to Help

NAB Bookkeeper is shutting down in April 2026. Switch to Gimbla for seamless NAB bank feeds via Open Banking and free BAS lodgement on our Plus Plan.

Claiming WFH Electricity: A Company Guide to ATO Rules

A simple guide for Australian companies on how to reimburse and claim home office electricity costs. Understand your ATO obligations and see clear, easy examples.

Which Accounting Software Is Used in Australia? 8 Top GST-Compliant Options for 2025

Gimbla stands out as a modern, GST-compliant accounting software designed for Australian businesses, alongside other popular tools like Xero, MYOB, and QuickBooks.

Should You Buy a Car Through Your Company or Personally? An ATO Guide

A detailed ATO Australia guide comparing Fringe Benefits Tax (FBT) vs. personal claims to help business owners decide the most tax-effective way to buy a car.

How to Record a Dividend Payout in Australia (Double-Entry Accounting Guide)

A step-by-step guide for Australian businesses on how to correctly record unfranked and franked dividend payouts in double-entry accounting software like Xero, MYOB, or QuickBooks.

Net Cash Flow from Investing Activities - Blog

Discover how Net Cash Flow From Investing Activities reveals a company's investment strategy and long-term growth plans. A crucial metric for assessing financial health.

What is Single Touch Payroll (STP)?

The data is transmitted directly from the payroll software to the ATO, reducing administrative burdens and ensuring compliance.