Tax Returns

Every company in Australia, including those just starting out or running at a loss, needs to file a Company Tax Return with the Australian Taxation Office (ATO) each year. This return reports your company’s income, tax deductions and credits, and ultimately determines your company’s tax liability for the financial year. Even if you don’t owe any tax, filing a return is mandatory.

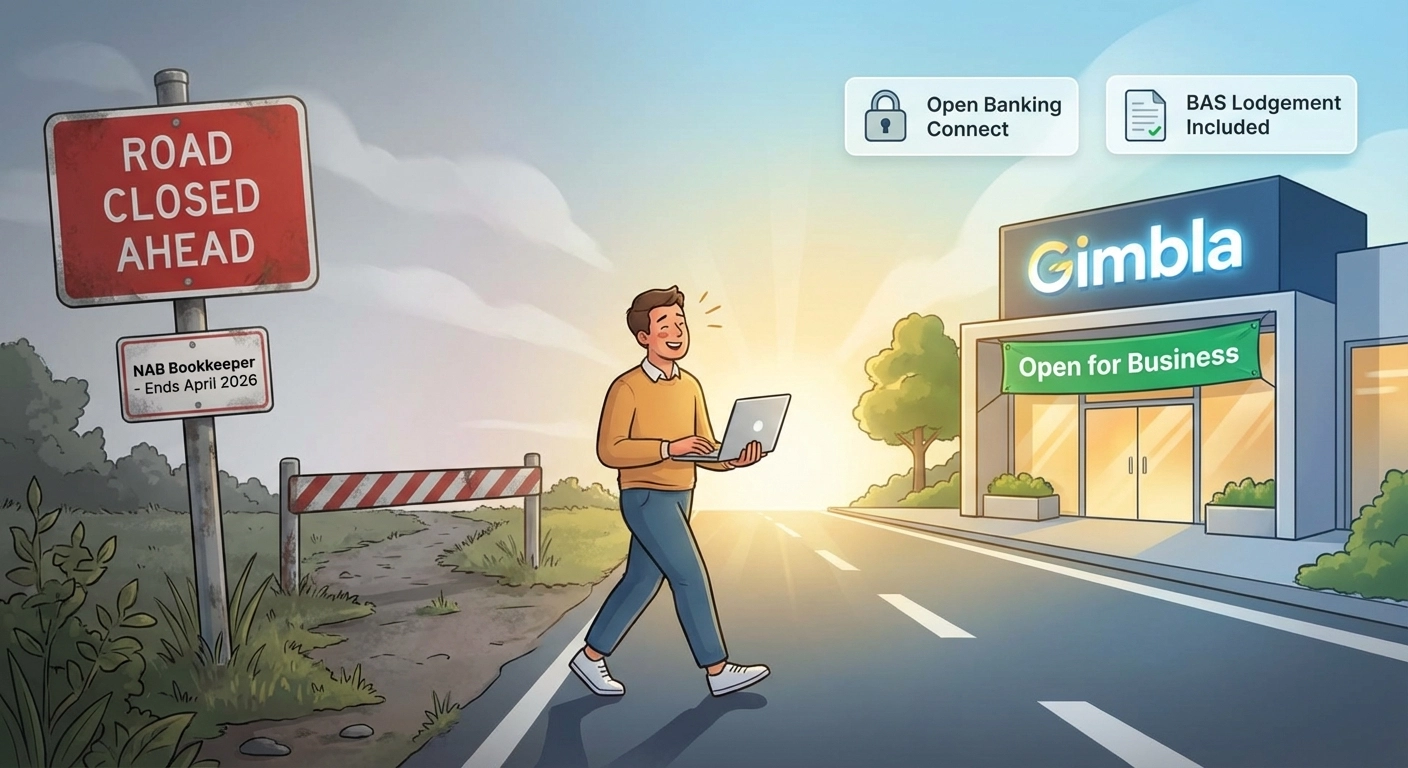

NAB Bookkeeper is Closing in April 2026: We’re Here to Help

NAB Bookkeeper is shutting down in April 2026. Switch to Gimbla for seamless NAB bank feeds via Open Banking and free BAS lodgement on our Plus Plan.

Claiming WFH Electricity: A Company Guide to ATO Rules

A simple guide for Australian companies on how to reimburse and claim home office electricity costs. Understand your ATO obligations and see clear, easy examples.

Which Accounting Software Is Used in Australia? 8 Top GST-Compliant Options for 2025

Gimbla stands out as a modern, GST-compliant accounting software designed for Australian businesses, alongside other popular tools like Xero, MYOB, and QuickBooks.

Should You Buy a Car Through Your Company or Personally? An ATO Guide

A detailed ATO Australia guide comparing Fringe Benefits Tax (FBT) vs. personal claims to help business owners decide the most tax-effective way to buy a car.

How to Record a Dividend Payout in Australia (Double-Entry Accounting Guide)

A step-by-step guide for Australian businesses on how to correctly record unfranked and franked dividend payouts in double-entry accounting software like Xero, MYOB, or QuickBooks.

A Beginner's Guide to the Australian Financial Year

The financial year is a designated period used by the Australian government for tax, budgeting, and financial reporting purposes.

When Can You Get Started on Your 2024 Tax Return?

As a business owner or director of a company in Australia, understanding your obligations around lodging company tax returns is essential.