Small Business

Small businesses play a pivotal role in driving economic growth and fostering community development. Often characterized by their entrepreneurial spirit and local roots, small businesses contribute significantly to job creation, innovation, and the overall vibrancy of economies. These enterprises, ranging from family-owned shops to innovative startups, form the backbone of many communities, providing goods and services that meet the unique needs of local residents. Small businesses also tend to be more agile and responsive to market changes, fostering adaptability and resilience. Additionally, they create a sense of community identity, as customers frequently develop personal relationships with owners and employees. Despite facing challenges, such as limited resources and competition, the impact of small businesses on the economic landscape cannot be overstated, emphasizing the importance of supporting their growth and sustainability.

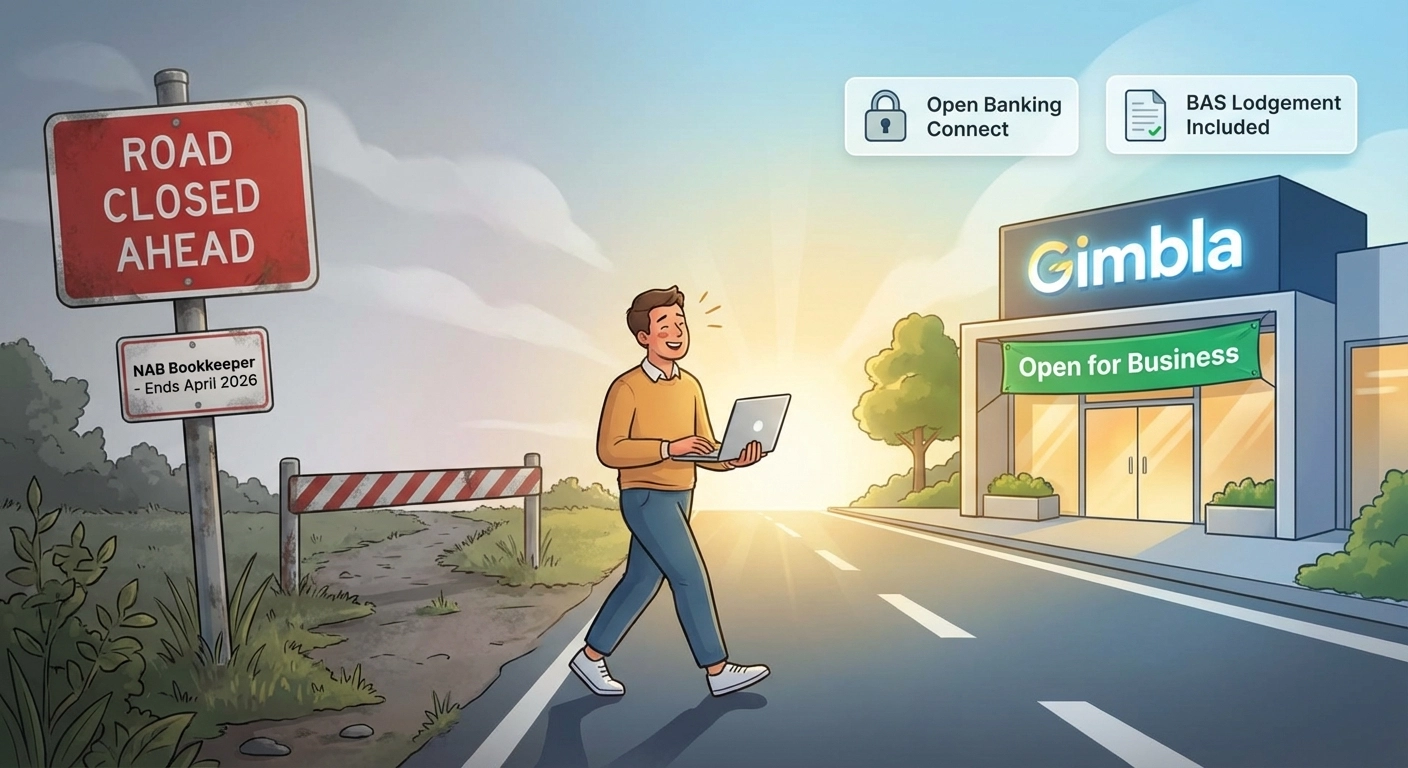

NAB Bookkeeper is Closing in April 2026: We’re Here to Help

NAB Bookkeeper is shutting down in April 2026. Switch to Gimbla for seamless NAB bank feeds via Open Banking and free BAS lodgement on our Plus Plan.

Claiming WFH Electricity: A Company Guide to ATO Rules

A simple guide for Australian companies on how to reimburse and claim home office electricity costs. Understand your ATO obligations and see clear, easy examples.

Which Accounting Software Is Used in Australia? 8 Top GST-Compliant Options for 2025

Gimbla stands out as a modern, GST-compliant accounting software designed for Australian businesses, alongside other popular tools like Xero, MYOB, and QuickBooks.

Should You Buy a Car Through Your Company or Personally? An ATO Guide

A detailed ATO Australia guide comparing Fringe Benefits Tax (FBT) vs. personal claims to help business owners decide the most tax-effective way to buy a car.

What Are Fuel Tax Credits?

Learn how Australian small businesses can reduce fuel costs with Fuel Tax Credits (FTCs). Eligibility, claim steps, and ATO updates to maximise savings.

How to Find Investors for Your Small Business

Finding investors for your small business can be a transformative step toward growth and success.

What is a VAT Number?

A VAT number is an essential identifier for businesses involved in taxable transactions, enabling them to comply with tax regulations, issue valid invoices, and engage in domestic and cross-border trade.